First Home Purchase – Introduction

It’s that time, your children are looking to make their first home purchase, but how are they going to achieve this? For parents, like us, this can be an extremely worrying time. You look at the property market and can’t begin to imagine how you can ever help them into their very own home.

We are all aware of the housing prices rising consistently over the last several years. Likewise, we see wages stagnating and the costs of living rising. These factors certainly make your first home purchase a challenge.

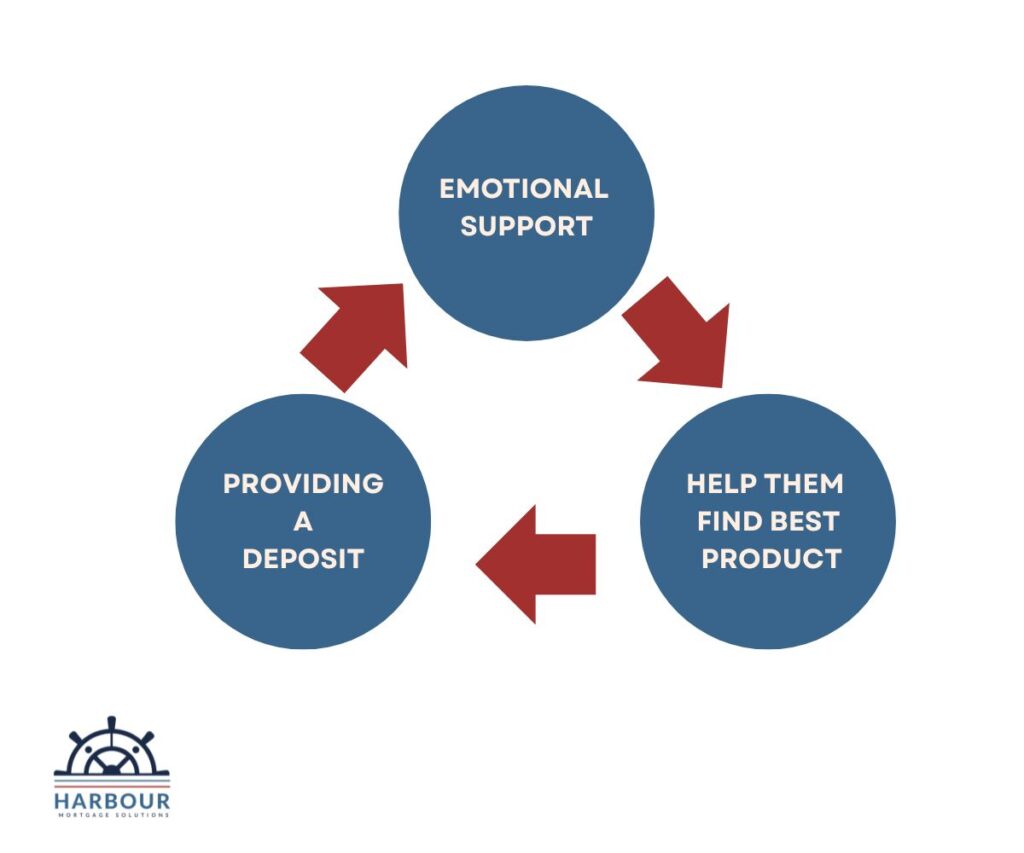

However, do not despair. There are ways we can support our children to get onto the property ladder.

Mortgage Lenders do understand the challenges that both parents and their children face and they want to help wherever possible. This article therefore looks at ways in which we, the parents, can support our offspring and help them to complete their first home purchase.

First Home Purchase: Emotional support

For those of us that have purchased a home before I’m sure you will remember how stressful the whole process was. When making your first home purchase having the support of friends and family is invaluable.

Seeking opinion and guidance is extremely important to help make clear decisions.

We all need emotional support and a safe space to share our thoughts. Our children especially need this to help relieve the stresses of house purchasing.

Listen to their concerns and worries and encourage them to find out the facts from expert Mortgage Advisers

Helping Them to Find the Best Product

A standard repayment mortgage is generally the most appropriate for first time buyers. In addition to this, there are mortgage products that can allow you, as a parents, to help your children with their first home purchase. For example, Sole Proprietor Joint Liability Mortgages and Guarantor Mortgages.

Also available are Family Springboard Mortgages. These enable you to put the money you would ordinarily gift for a deposit, into a savings account linked to the mortgage. This is especially useful if you have savings, but can’t afford to gift the money for a deposit.

A Family Springboard Mortgage will pay you interest on your savings, and you will be able to withdraw your funds after the mortgage term (or a specified time by a lender). The risk of this product is if your child fails to keep up with mortgage repayments, because a lender will use your savings to offset any losses.

Encourage them to speak to a registered mortgage advisor, offer to go with them to support their understanding.

First Home Purchase: Providing a Deposit

Saving for a deposit in today’s economic climate is extremely challenging for first-time buyers. If you are in the financial position to give your child some money towards their deposit it is worth considering.

However, there are a couple of elements you need to consider before gifting a deposit for a mortgage.

Any rights to money you gift to your children, for their first home purchase, need to be waived. This essentially means your children can keep the gifted money. You will be asked by the lender to sign a declaration stating “money is being given with no expectation of repayment”.

Inheritance tax must also be considered. Remember with any gift given, inheritance tax will be owed if your estate is over the inheritance tax threshold if you pass away within 7 years of the gift.

Be clear about the implications that come with gifting a deposit before offering your financial support and seek professional guidance.

Are we able to Gift Money?

For those parents in a position to be able to gift either part or all of the deposit needed in order to purchase a home this a very common route.

Size of the Deposit?

Some lenders will let you borrow with only a 5% deposit, however interest rates are generally higher. A 10% deposit is more typically common.

The Family Springboard mortgage mentioned previously is technically a 0% deposit mortgage, but at least a 10% deposit must be placed in the savings account associated with the mortgage.

Buying with their partner

When your children are buying their home with someone else gifting a deposit works in the same way. When we gift money in this way, we do need to remember that we are also supporting the second applicants equity stake within the property.

Whether we like it or not sometimes relationships falter and in this case the second applicant will benefit from any equity that is within the property. As mentioned previously you will be asked by the lender to sign a declaration stating “money is being given with no expectation of repayment”.

Releasing Equity from your home

Releasing Equity from your home

This option for supporting your children requires serious consideration due to the finical commitment it brings. As a result, it needs to be discussed with an Equity Release advisor to explore whether this is the right option for you. There is also some great advice to be found here on Age UK’s website.

Depending on individual circumstances you may be able to release equity from your property using Equity Release or by Capital Raising with a standard re-mortgage to gift a deposit.

With offers of fixed for life interest rates, no negative equity guarantees, permanent rights to reside, downsizing protections and more, regulated Equity Release products are now becoming more popular for those aged 55 or overlooking to release equity.

The Release of Equity is an excellent option for parents with not enough income to raise a standard residential mortgage against your property. Equity Release is not based on your income or financial commitments like a standard mortgage and is more focused on age and the value of your property. It’s extremely important to remember that Equity Release is generally more expensive than a standard re-mortgage to raise capital for gifting purposes.

With this in mind its important to speak with an experienced Equity Release advisor that can assess the whole of the mortgage market to find the best options available to you.

Conclusion: First Home Purchase

Helping your children make their first home purchase may seem overwhelming, but with the right support, it is possible. From emotional guidance to financial assistance, there are many ways to ease the journey. Whether you explore mortgage options, contribute to a deposit, or consider equity release, careful planning is key.

Encourage your children to seek expert advice, weigh all available options, and make informed decisions. Homeownership is a big step, but with your support, they can make their first home purchase with confidence. Ready to get started? Speak to a mortgage advisor today and help turn their dream into reality!