Help To Buy Mortgage

Your First Step Home – Expert Help To Buy Mortgage Solutions Tailored for You.

Help To Buy Mortgage Scheme: Equity Loan

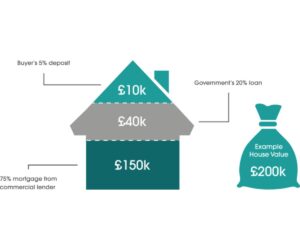

The Help to Buy Mortgage Scheme: Equity Loan is designed to make buying a new-build home more affordable. With this scheme, the government lends you up to 20% of the property’s price (or up to 40% in London). This means you only need a 5% deposit, while the remaining 75% (or 55% in London) comes from a standard mortgage.

One of the biggest benefits? You won’t pay any loan fees on the government’s loan for the first five years. From year six, a small interest fee applies, starting at 1.75% and increasing each year with inflation.

How Repayments Work

When you sell your home or finish repaying your mortgage, you must repay the equity loan as a percentage of the home’s current value.

Let’s look at the example above. If you buy a home for £200,000, your mortgage and deposit cover £160,000 (80%), while the government provides a £40,000 (20%) equity loan. If the property later sells for £210,000, you’ll get £168,000 (80%) then repay the Government £42,000 20% of the sales value, rather than the original loan amount.

Who Can Use the Help to Buy Mortgage Scheme?

- The scheme is only available to first-time buyers.

- It applies to new-build homes only.

- There are regional price limits, so the property must be within the scheme’s price cap for your area.

- You must plan to live in the home—buy-to-let purchases are not eligible.

The Help to Buy mortgage Scheme can be a great way to get on the property ladder with a smaller deposit and lower initial costs. However, it’s important to understand how repayments work in the long term.

For more information (including advice on fees and paying back your loan) please follow this link to the HM Government website Help-To-Buy: Equity Loan

Alternatively, if you want to know if the scheme is right for you, fill out the form below today for expert, friendly advice!

Frequently Asked Questions

Can I make home improvements while under the Help to Buy mortgage – Wales scheme?

Whilst maintenance of the property is your responsibility, home improvements are restricted while under the scheme. You’ll need written approval from Help to Buy (Wales) Ltd, especially for structural changes. If you’re unsure what’s allowed, a local mortgage broker in Barry can help explain the restrictions and how they may affect your long-term mortgage planning.

Can I repay part of the equity loan before selling my home?

Yes, through a process called “staircasing.” You can repay in chunks of at least 10% of the property’s value. One of our qualified mortgage brokers in Barry can help arrange a remortgage or assess your finances to make this possible.

Can I sublet my property under this scheme?

No. Subletting your property is not allowed under the Help to Buy mortgage scheme in Wales. The property must be your primary residence, and renting it out could breach the terms of your agreement.

What if I fall behind on my equity loan payments?

If you experience financial difficulties and fall into arrears, Help to Buy (Wales) Ltd will work with you to find a suitable repayment plan. It’s important to communicate with them promptly to address any issues and avoid further complications. Alternatively, speak to us, we can also help review your mortgage options to help reduce monthly costs if you are struggling.

Can I remortgage my property under the scheme?

Yes, you can, but you must obtain approval from Help to Buy (Wales) Ltd. If you’re remortgaging to repay part or all of the equity loan, this is usually approved. However, remortgaging for other reasons requires their consideration and approval.